Sectors that are heavily dependent on migrant workers, however, reported easing constraints

by RUPINDER SINGH / pic TMR FILE

article from https://themalaysianreserve.com/2023/03/06/corporate-malaysia-earnings-momentum-waning-in-4q/

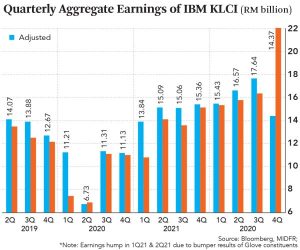

The recently concluded fourth quarter (4Q) earnings season saw an almost flat set of results. However, one research house observed that corporates’ cautious outlook is already being reflected in net earnings downgrades for 2023.

RHB Investment Bank Research (RHB Research) noted that as in preceding quarters, rising costs have made tangible dents on margins and bottom lines.

“The broader operating environment is likely to worsen before improving, and this points to market volatility in the quarters ahead.

“Following the earnings downgrades, we commensurately cut our end-2023 FTSE Bursa Malaysia KLCI (FBM KLCI) target to 1,590 points (from 1,660 points),” RHB regional research head Alexander Chia said in a recent research note.

For the December quarter, RHB Research noted that six sectors namely, automotive, media, healthcare, utilities, rubber products and basic materials were deemed to have disappointed.

This, it said, was offset by three sectors — banks, non-bank financials (NBFIs) and transport while other large-cap sectors were in line with its estimates.

It noted that sectors that are heavily dependent on migrant workers reported easing constraints, with the plantation and construction sectors’ results coming within estimates.

“The misses-to-beats ratio crept higher to 1.0 (from 0.8 in the last two preceding quarters) after 27.4% of earnings beat, offset by 27.4% that missed.

The financial year 2023 (FY23) earnings within our coverage universe were slashed by 3.5% with the biggest cuts coming from banks, oil and gas (O&G), and gloves,” Chia said.

Of the FBM KLCI stocks that RHB Research covers, Chia noted that there were five beats and seven misses.

“More importantly however, is the 4.1% and 5% cut in FY23 and FY24 earnings estimates,” he said.

He said the heavy-weight banking sector saw forecasts down by 3%, mainly from net interest margin (NIM compression) and revised his view on petrochemical prices, which are likely to be more sluggish than previously anticipated.

“Together with cuts in earnings forecasts from basic materials, utilities, telecommunications and automotive, FY23 recurring earnings were lowered by RM2.8 billion,” said Chia, adding that while there are some upside risks from the banks writing back excess provisions going forward, that is not yet the base case as of now.

Tailwinds For Equity Markets

On strategy, Chia said Research still expects the maturing monetary tightening cycle, cresting US inflation, a resilient US economy, a resurgent China and reduced domestic political risks to act as tailwinds for equity markets.

Adding to these positives, Chia said are the easing of regulatory risks as fears of punitive new taxes failed to materialise in the recently re-tabled Budget 2023.

While equity markets will be buffeted by volatility from softer macro-economic and corporate data points, Chia said market weakness should be seen as opportunities to gradually deploy cash hoards to add equity positions for the medium term.

Chia said for ward valuations are not especially demanding with the FBM KLCI now at just 13.7 times of FY24 price-to-earnings ratio and earnings growth is now just at 4%.

He said robust fundamentals are a key investment consideration, and thus the research house retains a ‘Preference’ for large-cap value stocks.

RHB Research is ‘Overweight’ on banks, O&G, gaming, basic materials, NBFIs, healthcare, auto and property.

According to Hong Leong Investment Bank Research (HLIB Research), the aggregate core earnings for corporate Malaysia under its coverage universe in 2022 was flattish.

For the recently concluded 4Q22 results season, it said that out of the 118 stocks under its coverage, 42% came in within expectations, 31% below and 27% above.

When stacked against consensus, the research firm noted that 44% were inline, 29% below and 28% above.

“In comparison to the preceding quarter (such as 3Q22), there was an increase in disappointments (25% to 31%), while results that exceeded expectations saw a slight decline (28% to 27%).

“Consequently, from a ratio perspective (% of results above/ below), this decreased quarter-on-quarter from 1.14 times to 0.89 times. A similar trend was also witnessed for consensus, with the ratio declining from 1.43 times to 0.97 times, it said.

HLIB Research said notable results misses came from building materials due to company-specific reasons, gloves (all in the red due to weak average selling price and volume), media (softer advertising expenditure and higher newsprint cost), healthcare (non-hospital ones namely Pharmaniaga Bhd and UMediC Group Bhd) and REITs (office-based ones).

On the other hand, it noted that positive results surprises stemmed from the construction sector and to a lesser extent the banking segment.

HLIB Research estimates that aggregate core earnings for its coverage universe slipped 4.6% on a quarterly basis largely dragged by Petronas Chemicals Group Bhd and Tenaga Nasional Bhd but rose 7.9% on a yearly basis.

For the 12 months of 2022, it said the aggregate core earnings is estimated to have inched up 2.5% with most companies seeing earnings recovery.

Another Rate Hike on The Table for the US

Moving forward, HLIB Research said while the US Federal Reserve (Fed) has dialled back on its rate hike quantum, there is now increasing probability that this may pick-up again possibly with another 50 basis points increase during the March Federal Open Market Committee or with a higher terminal rate.

Such a scenario, it said, spells further widening in the Fed Funds Rate Overnight Policy Rate spread, which the FBM KLCI is inversely correlated to at -57%.

“We expect the market to remain choppy until mid-year which is when the US rate upcycle would probably peak.

“In addition, US recession probability readings continue to remain elevated but its contagion effect could be cushioned by China’s timely reopening.

“Domestically, the re-tabled Budget 2023 was a relatively muted one — this isn’t necessarily a bad thing as risk of ‘market unfriendly measures’ being thrown in have now subsided,” it said.

Following the earnings adjustments post-4Q22 results, HLIB Research lowered its FBM KLCI target from 1,580 to 1,560.

“Our FBM KLCI earnings per share forecast is 8.4% below consensus, in part reflecting the lack of earnings clarity from an uncertain macro backdrop,” it said.

Meanwhile, Public Investment Bank Bhd (PublicInvest Research) has kept its end of 2023 FBM KLCI target unchanged at 1,650 points, as no major revisions to earnings of index-component stocks were seen in the 4Q22.

PublicInvest Research said earnings of heavily-weighted banks and plantations were largely unchanged in 4Q, with tweaks in telecommunications (positive) and chemical/consumer (negative) largely negating each other.

“The 2023 and 2024 earnings baskets are anticipated to expand by 9.6% and 5.8% (respectively), the slightly more pronounced 2023 growth a result of base effects,” it said.

On the broader market, the investment bank said it remained cautious but not overly pessimistic for the remainder of the year.

“Though the FBM KLCI continues to struggle to break out of its range-bound trading band, sufficient reasons warrant continued exposure in the market. However, uncertainties and resultant volatilities will be an ongoing feature.

“Fundamentally, macro conditions in 2023 are not too dissimilar to that of 2022,” it said.

Moving forward, PublicInvest Research cautioned that the first half of 2023 (1H23) would remain uncertain as global economies work through the full effects of aggressive rate hikes over the last six months.

“Sentiment is weak, understandably, but the market is also relatively undervalued (now more so) with the earnings picture not having been despite this quarter’s apparent wobble.

“We wouldn’t be in a hurry to get into the market at this juncture, but retain sufficient optimism to suggest buying into market weakness to ride on the upside going into 2H23,” it said.

Going into 2024, it said Malaysia’s economic growth direction and earnings picture would depend on the severity or wear-off of the downside risks, which, at this point, is not expected to be severe.

0 Comments